ad valorem tax florida real estate

PDF 125 KB Individual and Family Exemptions Taxpayer Guides. Ad Download Or Email FL DR-418 More Fillable Forms Register and Subscribe Now.

What Is A Homestead Exemption And How Does It Work Lendingtree

Both the ad valorem tax and the non ad valorem assessment are due November 1st of each year in order to take advantage of the 4 discount not the focus of this blog Authority for Ad Valorem Taxes.

. Ad valorem tax means according to value. The most common ad valorem taxes are property taxes levied on real estate. Ad Get Access to the Largest Online Library of Legal Forms for Any State.

Ad Valorem taxes are based on the assessed value and the millage of each taxing authority. There are two types of ad valorem property taxes in Florida which are Real Estate Property and Tangible Personal Property. Real Estate Family Law Estate Planning Business Forms and Power of Attorney Forms.

Ad valorem means based on value. By email or visit one of our offices. Which statement is FALSE regarding property taxes.

So all ad valorem taxes are based on the assessed value of the item being taxed. The real estate tax bill is a combined notice of ad valorem taxes and non-ad valorem assessments. The full amount of taxes owed is due by March 31.

3 if paid in December. The taxes are assessed on a calendar year from Jan through Dec 365 days. Rennert Vogel Mandler Rodriguez has one of the largest and most successful ad valorem taxation departments in Florida.

There are three ways to pay your property taxes online with Paperless in person or by mail. The greater the value the higher the assessment. Annual property tax bills are mailed on or before November 1.

The Non- Ad valorem tax roll is prepared and provided to the Board of County Commissioners by the Tax Collectors Office. The Property Appraiser establishes the taxable value of real estate property. Ad valorem taxes can be assessed once when an item is first purchased or brought across country lines.

In January PTO releases the second and final publication which contains the most current values the Department has received as well. Our attorneys have a wealth of knowledge and experience in all aspects of property tax law and appeals to help taxpayers control costs and ensure they are not paying. Ad Valorem based on value taxes for Real Property and Tangible Personal Property are collected by the Tax Collector on an annual basis beginning on November 1st for the tax year January through December.

Ad valorem which means according to value in Latin refers to the fact that a tax is levied as a percentage of a propertys value. Taxes are assessed by the Property Appraiser as of January 1 of each year and levied in Hillsborough County by the taxing. Ad Valorem Tax.

The actual amount of the taxes is 477965. Taxes are assessed by the property appraiser as of january 1 of. 4 if paid in November.

The county property appraiser assesses all real property within the county. Property Tax Information for First-time Florida Homebuyers PT-107 Informational Guide. Sales and Use Tax.

The most common ad valorem taxes are property taxes levied on real estate. Real property is located in described geographic areas designated as parcels. Ad valorem taxes are based on the value of the property.

Florida ad valorem valuation and tax data book. Taxes are assessed by the Property Appraiser as of January 1 of each year and levied in Hillsborough County by the taxing. These tax statements are mailed out on or before November 1st of each year with the following discounts in effect for early payment.

What is ad valorem tax exemption Florida. In cases where the property owner pays their real estate taxes into an escrow account their mortgage company should request the tax bill. Article VII of the Florida Constitution and Chapters 192 193 194.

Property tax can be one of the biggest single expense items for commercial properties. PdfFiller allows users to edit sign fill and share all type of documents online. 1 administer tax law for 36 taxes and fees processing nearly 375 billion and more than 10 million tax filings annually.

Property taxes become a lien on all real estate in Florida on January 1 each year. In Florida property taxes and real estate taxes are also known as ad valorem taxes. Examples of ad valorem taxes are school county and city taxes.

One valuable tax break which is available in a number of Florida counties and cities is the Economic Development Ad Valorem Tax Exemption. An ad valorem tax is a tax based on the estimated value of an item such as real estate or personal property. 1971221 from the first day of.

If any tax statements are missing please contact the Office of Will Roberts Tax Collector. Taxing authorities are responsible for setting ad valorem millage rates. Santa Rosa County property taxes provide the fund local governments to provide.

An ad valorem tax is a tax based on the assessed value of an item such as real estate or personal property. Ad Fill Sign Email FL DR-504 More Fillable Forms Register and Subscribe Now. Property Tax bills are mailed to property owners by November 1 of each year.

It is the responsibility of each taxpayer to ensure that hisher taxes are paid and that a tax bill is received. Authorized by Florida Statute 1961995 this incentive provides an exemption of up to 10 years from the property taxes both real property taxes and tangible personal property taxes payable with respect to business improvements such as a new building building expansion or new equipment purchased in connection with. The tangible tax bill is exclusively an ad valorem tax.

Based on those numbers getting the per diem ie the per day amount for our calculations is easy divide 477965 by 365 130949day. If you have not received your tax bill by the second week in November please contact us. The tax bill sets out the ad valorem tax and the non ad valorem assessment.

Economic Development Ad Valorem Property Tax Exemption R. These taxes are collected beginning November 1st each year and become delinquent April 1st. It includes land building fixtures and improvements to the land.

The Ad Valorem tax roll consists of real estate taxes and tangible personal property taxes. 4 discount if paid in November. In August PTO releases the first publication which contains preliminary assessment roll data.

Section 197122 Florida Statutes. The Property Tax Oversight PTO program publishes the Florida Ad Valorem Valuation and Tax Data Book twice a year. In Florida property taxes and real estate taxes are also known as ad valorem taxes.

2 if paid in January. By phone at 386-736-5938. Authorized by Florida Statute 1961995 this incentive provides an exemption of up to 10 years from the property taxes both real property taxes and tangible personal property taxes payable with respect.

Taxes on all real estate and other non-ad valorem assessments are billed collected and distributed by the Tax Collector. Lets look at the 2015 Ad Valorem taxes in detail. The total of these two taxes equals your annual property tax amount.

Under Florida Statute 197 the Tax Collector has the responsibility for the collection of ad valorem taxes and non-ad valorem taxes. The Latin phrase ad valorem means according to value. These are levied by the county municipalities and various taxing authorities in the county.

An ad valorem tax is based on the assessed value of an item such as real estate or personal property. Property taxes for the previous year are due on November 1. The ad valorem tax roll consists of.

Taxes usually increase along with the assessments subject to certain exemptions. The following early payment discounts are available to Orange County taxpayers.

Real Estate Property Tax Constitutional Tax Collector

Property Tax Appeals When How Why To Submit Plus A Sample Letter

How To Read Your Property Tax Bill O Connor Property Tax Reduction Experts Property Tax Tax Tax Reduction

Florida Real Estate Taxes And Their Implications

Your Guide To Prorated Taxes In A Real Estate Transaction

What Is Florida County Tangible Personal Property Tax

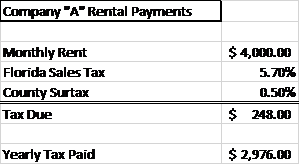

How To Calculate Fl Sales Tax On Rent

Florida Property Tax H R Block

Property Taxes Brevard County Tax Collector

Property Taxes Lake County Tax Collector

Florida Real Estate Taxes What You Need To Know

Ad Valorem Tax Overview And Guide Types Of Value Based Taxes